May 14, 2023 ONEOK TO ACQUIRE MAGELLAN MIDSTREAM PARTNERS IN TRANSACTION VALUED AT $18.8 BILLION

- Brings together two premier energy infrastructure businesses with strong returns on invested capital and diverse free cash flow generation

- Expect to achieve immediate financial benefits, including cost, operational and tax synergies, supporting meaningful expected accretion

- Compelling long-term value proposition driven by consistent and disciplined capital allocation philosophy

- Complementary and diversified asset positions with potential for additional cost and commercial synergies over time

- Strong investment-grade credit ratings with enhanced scale and diversification

TULSA, Okla., May 14, 2023 /PRNewswire/ — ONEOK, Inc. (NYSE: OKE) (“ONEOK”) and Magellan Midstream Partners, L.P. (NYSE: MMP) (“Magellan”) today announced that they have executed a definitive merger agreement under which ONEOK will acquire all outstanding units of Magellan in a cash-and-stock transaction valued at approximately $18.8 billion including assumed debt, resulting in a combined company with a total enterprise value of $60.0 billion. The consideration will consist of $25.00 in cash and 0.6670 shares of ONEOK common stock for each outstanding Magellan common unit, representing a current implied value to each Magellan unitholder of $67.50 per unit, for a 22% premium, based on May 12, 2023 closing prices.

STRATEGIC RATIONALE:

- Brings together two premier energy infrastructure businesses with strong returns on invested capital and diverse free cash flow generation: The transaction adds a leading, and primarily fee-based, refined products and crude oil transportation business to ONEOK. Magellan’s stable, primarily demand-driven businesses are expected to generate significant free cash flow due to low capital expenditure requirements. This acquisition creates a more resilient energy infrastructure company that is expected to produce stable cash flows through diverse commodity cycles.

- Expect to achieve immediate financial benefits, including cost, operational and tax synergies, supporting meaningful expected accretion: The transaction is expected to be earnings per share (EPS) accretive beginning in 2024 with EPS accretion of 3% to 7% per year from 2025 through 2027, and free cash flow per share accretion averaging more than 20% from 2024 through 2027. Base forecasted synergies are expected to total at least $200 million annually.

From a tax perspective, ONEOK expects to benefit from the step-up in Magellan’s tax basis from the transaction, thus deferring the expected impact of the new corporate alternative minimum tax from 2024 to 2027. The benefit from the basis step-up has an estimated total value of approximately $3.0 billion, which has an estimated net present value of approximately $1.5 billion. Utilization of expected tax attributes could increase if additional capital projects are put into service or acquisitions are completed, which may increase the net present value of future tax deferrals.

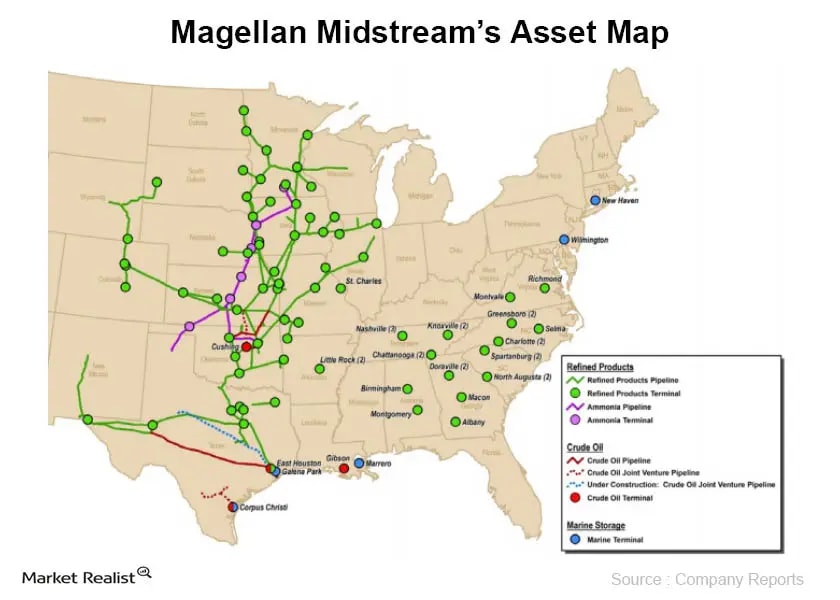

Compelling long-term value proposition driven by consistent and disciplined capital allocation philosophy: The combined company is expected to experience a step change in free cash flow after dividends and growth capital by generating an average annual amount of approximately $1.0 billion in the first four years following the expected transaction close. The increase in free cash flow will provide additional cash for debt reduction, growth capital and value returned to shareholders through dividends and/or repurchasing shares. ONEOK remains committed to growing both EPS and its common dividend while targeting a payout ratio of less than 85%. - Complementary and diversified asset positions with potential for additional cost and commercial synergies over time: The combined company will own more than 25,000 miles of liquids-oriented pipelines, with significant assets and operational expertise at the Gulf Coast and Mid-Continent market hubs. ONEOK anticipates this combined liquids-focused portfolio will present significant potential for enhanced customer product offerings and increased international export opportunities. We believe these activities could potentially result in total annual transaction synergies exceeding $400 million within two to four years.

- Strong investment-grade credit ratings with enhanced scale and diversification: The combined company expects pro-forma 2024 year-end net debt-to-EBITDA of approximately 4.0 times. ONEOK expects leverage to decrease below 3.5 times by 2026 as future growth projects are placed in service. Excluding certain large projects that have not yet received a final investment decision from the expected net debt-to-EBITDA calculation would accelerate the timeframe to achieve 3.5 times by approximately one year.

CEO PERSPECTIVE:

“ONEOK has a long history and track record of being at the forefront of transformational transactions. The combination of ONEOK and Magellan will create a diversified North American midstream infrastructure company with predominately fee-based earnings, a strong balance sheet and significant financial flexibility focused on delivering essential energy products and services to our customers and continued strong returns to investors,” said Pierce H. Norton II, ONEOK president and chief executive officer. “Our expanded products platform will present further opportunities in our core businesses as well as enhance our ability to participate in the ongoing energy transformation with an increased presence in sustainable fuel and hydrogen corridors. We are excited about the future of our combined companies and look forward to welcoming Magellan’s well-respected employees to ONEOK,” added Norton.

“Throughout more than 20 years as a publicly traded company, Magellan has remained focused on safe and responsible operations, financial discipline and long-term investor value. We believe ONEOK shares these priorities, and we are pleased to join them in creating a stronger, more diversified midstream company,” said Aaron Milford, Magellan president and chief executive officer. “We believe the premium offered maximizes value creation for Magellan’s unitholders and reflects the essential nature of Magellan’s assets and service offerings as well as the quality of our talented and innovative employees. This transaction provides a significant upfront cash component and an opportunity for Magellan investors to benefit from the attractive cash dividend offered by the combined company going forward.”

TRANSACTION DETAILS:

Magellan will be merged into a newly created 100% wholly-owned subsidiary of ONEOK.

Each Magellan unitholder will receive $25.00 in cash and 0.6670 shares of ONEOK stock per unit. This represents a 22% premium to the Magellan closing price on May 12, 2023.

The transaction is expected to close in the third quarter of 2023 and has been unanimously approved by the board of directors of both companies. ONEOK has secured $5.25 billion in fully committed bridge financing for the proposed cash consideration. The closing of the transaction is subject to customary closing conditions, including the approvals of both ONEOK shareholders and Magellan unitholders, as well as Hart Scott Rodino Act clearance.

Following the close of the transaction, Pierce Norton will continue to serve as chief executive officer of the combined company. ONEOK intends to seek and nominate one or two director(s) serving on the board of Magellan’s general partner.

TAX IMPLICATIONS:

The transaction will be a taxable event for Magellan unitholders and will cause ONEOK to have a step-up in tax basis approximately equal to the aggregate purchase price of Magellan units and Magellan debt assumed (approximately $18.8 billion). The premium and cash portion of the consideration may assist with potential tax implications for Magellan unitholders occurring from this transaction. This transaction is expected to defer significant corporate cash tax liability into future periods for the combined entity.

CONFERENCE CALL INFORMATION:

ONEOK’s chief executive officer and chief financial officer, along with Magellan’s chief executive officer, will host a conference call on Monday, May 15 at 8:30 a.m. Eastern Daylight Time (7:30 a.m. Central Daylight Time) to discuss the transaction.

To participate in the telephone conference call, dial 877-883-0383, entry number 9948090 or log on to ONEOK’s Investor Relations website https://ir.oneok.com/ under “Events & Presentations” or Magellan’s website at www.magellanlp.com/investors/webcasts.aspx.

A replay will be made available on both websites for seven days and may be accessed at 877-344-7529, access code 4668799.

TRANSACTION PRESENTATION:

Additional information that will be discussed on the conference call is accessible by selecting the link below.

https://ir.oneok.com/news-and-events/events-and-presentations

ADVISORS:

Goldman Sachs & Co. LLC is serving as lead financial advisor to ONEOK and Goldman Sachs Bank USA is providing fully committed bridge financing. BofA Securities and TPH&Co., the energy business of Perella Weinberg Partners, also advised ONEOK. Kirkland & Ellis LLP is serving as ONEOK’s legal advisor.

Morgan Stanley & Co. LLC is serving as financial advisor to Magellan. Latham & Watkins LLP and Richards, Layton & Finger, P.A. are acting as Magellan’s legal advisors.

ABOUT ONEOK:

ONEOK, Inc. (pronounced ONE-OAK) (NYSE: OKE) is a leading midstream service provider and owns one of the nation’s premier natural gas liquids (NGL) systems, connecting NGL supply in the Rocky Mountain, Permian and Mid-Continent regions with key market centers and owns an extensive network of gathering, processing, fractionation, transportation and storage assets. More information is available at www.oneok.com.

ONEOK is a FORTUNE 500 company and is included in the S&P 500.

ABOUT MAGELLAN MIDSTREAM PARTNERS:

Magellan Midstream Partners, L.P. (NYSE: MMP) is a publicly traded partnership that primarily transports, stores and distributes refined petroleum products and crude oil. Magellan owns the longest refined petroleum products pipeline system in the country, with access to nearly 50% of the nation’s refining capacity, and can store more than 100 million barrels of petroleum products such as gasoline, diesel fuel and crude oil. More information is available at www.magellanlp.com.

Magellan Midstream Asset Map

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT:

In connection with the proposed merger (the “Proposed Transaction”) between ONEOK and Magellan, ONEOK intends to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “Registration Statement”) to register the shares of ONEOK’s common stock to be issued in connection with the Proposed Transaction. The Registration Statement will include a document that serves as a prospectus of ONEOK and joint proxy statement of ONEOK and Magellan (the “joint proxy statement/prospectus”), and each party will file other documents regarding the Proposed Transaction with the SEC. INVESTORS AND SECURITY HOLDERS OF ONEOK AND MAGELLAN ARE URGED TO CAREFULLY AND THOROUGHLY READ, WHEN THEY BECOME AVAILABLE, THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY ONEOK AND MAGELLAN WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ONEOK AND MAGELLAN, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

After the Registration Statement has been declared effective, a definitive joint proxy statement/prospectus will be mailed to shareholders of ONEOK and unitholders of Magellan. Investors will be able to obtain free copies of the Registration Statement and the joint proxy statement/prospectus, as each may be amended from time to time, and other relevant documents filed by ONEOK and Magellan with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by ONEOK, including the joint proxy statement/prospectus (when available), will be available free of charge from ONEOK’s website at www.oneok.com under the “Investors” tab. Copies of documents filed with the SEC by Magellan, including the joint proxy statement/prospectus (when available), will be available free of charge from Magellan’s website at www.magellanlp.com under the “Investors” tab.

PARTICIPANTS IN THE SOLICITATION:

ONEOK and certain of its directors, executive officers and other members of management and employees, Magellan, and certain of the directors, executive officers and other members of management and employees of Magellan GP, LLC, which manages the business and affairs of Magellan, may be deemed to be participants in the solicitation of proxies from ONEOK’s shareholders and the solicitation of proxies from Magellan’s unitholders, in each case with respect to the Proposed Transaction. Information about ONEOK’s directors and executive officers is available in ONEOK’s Annual Report on Form 10-K for the 2022 fiscal year filed with the SEC on February 28, 2023, and its definitive proxy statement for the 2023 annual meeting of stockholders filed with the SEC on April 5, 2023, and in the joint proxy statement/prospectus (when available). Information about Magellan’s directors and executive officers is available in its Annual Report on Form 10-K for the 2022 fiscal year and its definitive proxy statement for the 2023 annual meeting of unitholders, each filed with the SEC on February 21, 2023, and the joint proxy statement/prospectus (when available). Other information regarding the participants in the solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Registration Statement, the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction when they become available. Shareholders of ONEOK, unitholders of Magellan, potential investors and other readers should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

NO OFFER OR SOLICITATION:

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

FORWARD-LOOKING STATEMENTS:

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that ONEOK or Magellan expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “would,” “may,” “plan,” “will,” “guidance,” “look,” “goal,” “future,” “build,” “focus,” “continue,” “strive,” “allow” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the Proposed Transaction, the expected closing of the Proposed Transaction and the timing thereof and as adjusted descriptions of the post-Transaction company and its operations, strategies and plans, integration, debt levels and leverage ratio, capital expenditures, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future performance, including maintaining current ONEOK management, enhancements to investment-grade credit profile, an expected accretion to earnings and free cash flow, dividend payments and potential share repurchases, increase in value of tax attributes and expected impact on EBITDA. Information adjusted for the Proposed Transaction should not be considered a forecast of future results. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the risk that ONEOK’s and Magellan’s businesses will not be integrated successfully; the risk that cost savings, synergies and growth from the Proposed Transaction may not be fully realized or may take longer to realize than expected; the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the possibility that shareholders of ONEOK may not approve the issuance of new shares of ONEOK common stock in the Proposed Transaction or that shareholders of ONEOK or unitholders of Magellan may not approve the Proposed Transaction; the risk that a condition to closing of the Proposed Transaction may not be satisfied, that either party may terminate the Merger Agreement or that the closing of the Proposed Transaction might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Proposed Transaction; the parties do not receive regulatory approval of the Proposed Transaction; the occurrence of any other event, change or other circumstances that could give rise to the termination of the Merger Agreement relating to the Proposed Transaction; the risk that ONEOK may not be able to secure the debt financing necessary to fund the cash consideration required for the Proposed Transaction; the risk that changes in ONEOK’s capital structure and governance could have adverse effects on the market value of its securities; the ability of ONEOK and Magellan to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on ONEOK’s and Magellan’s operating results and business generally; the risk the Proposed Transaction could distract management from ongoing business operations or cause ONEOK and/or Magellan to incur substantial costs; the risk that ONEOK may be unable to reduce expenses or access financing or liquidity; the impact of the COVID-19 pandemic, any related economic downturn and any related substantial decline in commodity prices; the risk of changes in governmental regulations or enforcement practices, especially with respect to environmental, health and safety matters; and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond ONEOK’s or Magellan’s control, including those detailed in ONEOK’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on ONEOK’s website at www.oneok.com and on the website of the Securities and Exchange Commission (the “SEC”) at www.sec.gov, and those detailed in Magellan’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on Magellan’s website at www.magellanlp.com and on the website of the SEC. All forward-looking statements are based on assumptions that ONEOK and Magellan believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and neither ONEOK nor Magellan undertakes any obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

CONTACTS:

ONEOK, Inc.

Investor Relations:

Andrew Ziola

Phone: (918) 588-7683

ONEOKInvestorRelations@oneok.com

Media Relations:

Brad Borror

Phone: (918) 588-7582

brad.borror@oneok.com

Magellan Midstream Partners, L.P.

Investor Relations:

Paula Farrell

Phone: (918) 574-7650

paula.farrell@magellanlp.com

Media Relations:

Bruce Heine

Phone: (918) 574-7010

bruce.heine@magellanlp.com

CisionView original content:https://www.prnewswire.com/news-releases/oneok-to-acquire-magellan-midstream-partners-in-transaction-valued-at-18-8-billion-301824088.html

SOURCE ONEOK, Inc