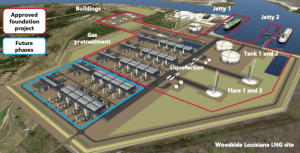

Woodside Energy has officially approved the development of its three-train, 16.5 million tonnes per annum (Mtpa) Louisiana LNG project, with first production targeted for 2029. The decision marks a pivotal milestone for the Australian energy company as it deepens its presence in the United States and aims to operate more than 5% of the global LNG supply in the next decade. With a forecasted capital expenditure of $17.5 billion, the development represents the largest single foreign direct investment in Louisiana’s history, according to Woodside’s press release.

Courtesy of Woodside Energy

“This world-class project is a game-changer for Woodside, set to position our company as a global LNG powerhouse and enable us to deliver enduring shareholder returns,” said Woodside CEO Meg O’Neill. She emphasized the project’s strategic value, highlighting its 40-year lifespan, access to low-cost U.S. gas resources, and connectivity to both the Atlantic and Pacific markets. The Louisiana LNG site is fully permitted for future expansion to 27.6 Mtpa, underscoring its long-term growth potential.

Courtesy of Meg O’Neill LinkedIn

Financially, the project is expected to be highly lucrative. At full capacity, the foundation phase is forecast to generate approximately $2 billion in annual net operating cash, contributing to a projected $8 billion across Woodside’s global portfolio in the 2030s. The project exceeds internal investment thresholds, delivering an internal rate of return above 13% and a payback period of just seven years. Woodside’s share of the capital expenditure is estimated at $11.8 billion, with infrastructure investor Stonepeak contributing $5.7 billion and covering 75% of the capital outlay in both 2025 and 2026.

Despite the scale of the investment, Woodside affirmed that its climate commitments remain intact. The company stated that the project will not alter its existing greenhouse gas reduction targets. Key design features include flareless restarts, methane leakage mitigation, and electric-drive compressors that reduce operational emissions. “The Louisiana LNG development will be operated consistent with Woodside’s OGMP 2.0 plan,” the company noted, referencing its participation in the UN-backed methane reduction initiative.

In addition to generating significant returns and maintaining climate accountability, the project will also provide a major economic boost. Woodside expects the project to support approximately 15,000 jobs during construction and create over 4,000 operational jobs in the U.S. “We are pleased with the strong level of interest from potential strategic partners and are advancing discussions targeting further equity sell-downs,” O’Neill added, reflecting the company’s strategy to de-risk through collaboration while preserving long-term value creation.

Written by João Fernando