DALLAS–(BUSINESS WIRE)–May 6, 2025– Energy Transfer LP (NYSE:ET) (“Energy Transfer” or the “Partnership”) today reported financial results for the quarter ended March 31, 2025.

Energy Transfer reported net income attributable to partners for the three months ended March 31, 2025 of $1.32 billion compared to $1.24 billion for the three months ended March 31, 2024. For the three months ended March 31, 2025, net income per common unit (basic) was $0.37.

Adjusted EBITDA for the three months ended March 31, 2025 was $4.10 billion compared to $3.88 billion for the three months ended March 31, 2024.

Distributable Cash Flow attributable to partners, as adjusted, for the three months ended March 31, 2025 was $2.31 billion compared to $2.36 billion for the three months ended March 31, 2024.

Growth capital expenditures in the first quarter of 2025 were $955 million, while maintenance capital expenditures were $165 million.

Operational Highlights

- Energy Transfer’s volumes continued to grow during the first quarter of 2025 compared to the first quarter of 2024.

- Interstate natural gas transportation volumes were up 3%, setting a new Partnership record.

- Crude oil transportation volumes were up 10%.

- NGL transportation volumes were up 4%.

- NGL and refined products terminal volumes were up 4%.

- NGL exports were up 5%.

- Midstream gathered volumes were up more than 2%.

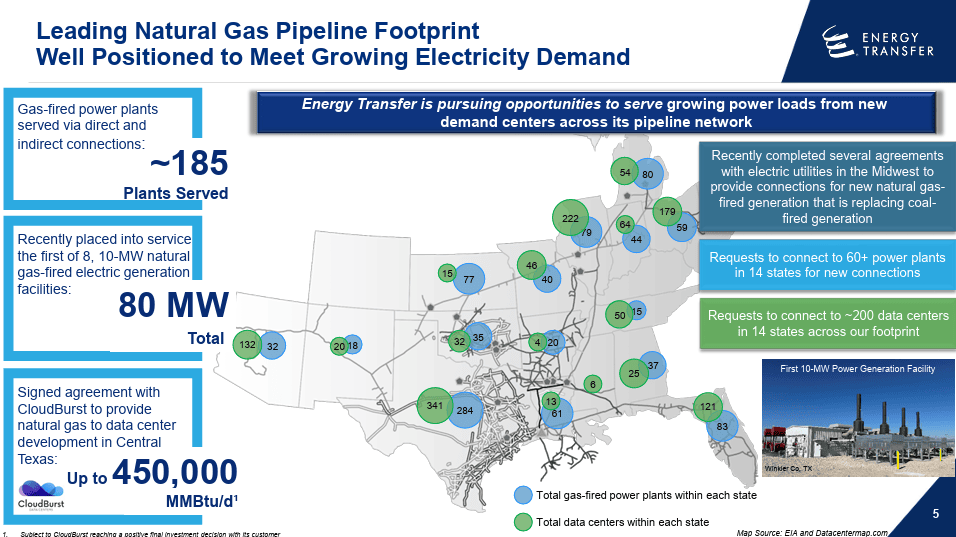

- In February 2025, Energy Transfer commissioned the first of eight, 10-megawatt natural gas-fired electric generation facilities to support the Partnership’s operations in Texas.

- During the first quarter of 2025, Energy Transfer commenced construction of Phase I of the Hugh Brinson Pipeline and secured all pipeline steel, which is currently being rolled in U.S. pipe mills.

Courtesy of ETC

Strategic Highlights

- In April 2025, Energy Transfer entered into a Heads of Agreement with MidOcean Energy (“MidOcean”) for the joint development of the Lake Charles LNG project, under which MidOcean would commit to fund 30% of the construction costs and be entitled to receive 30% of the LNG production.

- In February 2025, Energy Transfer entered into a long-term agreement with Cloudburst Data Centers, Inc. (“CloudBurst”) to provide natural gas to CloudBurst’s flagship AI-focused data center development.

- In February 2025, Energy Transfer approved construction of an additional natural gas processing plant in the Midland Basin. The Mustang Draw plant will have a processing capacity of approximately 275 MMcf/d and is expected to be in service in the second quarter of 2026.

Courtesy of ETC

Financial Highlights

- In April 2025, Energy Transfer announced a quarterly cash distribution of $0.3275 per common unit ($1.31 annualized) for the quarter ended March 31, 2025, which is an increase of more than 3% compared to the first quarter of 2024.

- As of March 31, 2025, the Partnership’s revolving credit facility had an aggregate $4.37 billion of available borrowing capacity.

- The Partnership continues to expect its 2025 Adjusted EBITDA to be between $16.1 billion and $16.5 billion, and its 2025 growth capital expenditures to be approximately $5 billion.

Energy Transfer benefits from a portfolio of assets with exceptional product and geographic diversity. The Partnership’s multiple segments generate high-quality, balanced earnings with no single segment contributing more than one-third of the Partnership’s consolidated Adjusted EBITDA for the three months ended March 31, 2025. The vast majority of the Partnership’s segment margins are fee-based and therefore have limited commodity price sensitivity.

Conference call information:

The Partnership has scheduled a conference call for 3:30 p.m. Central Time/4:30 p.m. Eastern Time on Tuesday, May 6, 2025 to discuss its first quarter 2025 results and provide an update on the Partnership. The conference call will be broadcast live via an internet webcast, which can be accessed through www.energytransfer.com and will also be available for replay on the Partnership’s website for a limited time.

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with more than 130,000 miles of pipeline and associated energy infrastructure. Energy Transfer’s strategic network spans 44 states with assets in all of the major U.S. production basins. Energy Transfer is a publicly traded limited partnership with core operations that include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, natural gas liquids (“NGL”) and refined product transportation and terminalling assets; and NGL fractionation. Energy Transfer also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and approximately 21% of the outstanding common units of Sunoco LP (NYSE: SUN), and the general partner interests and approximately 39% of the outstanding common units of USA Compression Partners, LP (NYSE: USAC). For more information, visit the Energy Transfer LP website at www.energytransfer.com.

Sunoco LP (NYSE: SUN) is a leading energy infrastructure and fuel distribution master limited partnership operating in over 40 U.S. states, Puerto Rico, Europe, and Mexico. SUN’s midstream operations include an extensive network of approximately 14,000 miles of pipeline and over 100 terminals. This critical infrastructure complements SUN’s fuel distribution operations, which serve approximately 7,400 Sunoco and partner branded locations and additional independent dealers and commercial customers. SUN’s general partner is owned by Energy Transfer LP (NYSE: ET). For more information, visit the Sunoco LP website at www.sunocolp.com.

USA Compression Partners, LP (NYSE: USAC) is one of the nation’s largest independent providers of natural gas compression services in terms of total compression fleet horsepower. USAC partners with a broad customer base composed of producers, processors, gatherers, and transporters of natural gas and crude oil. USAC focuses on providing midstream natural gas compression services to infrastructure applications primarily in high-volume gathering systems, processing facilities, and transportation applications. For more information, visit the USAC website at www.usacompression.com.

Forward-Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results, including Adjusted EBITDA, and impact current projections, including capital expenditures, are discussed in the Partnership’s Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. The Partnership undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at www.energytransfer.com.

To read this whole article and view the condensed consolidated balance sheets, consolidated statements of operations, and supplemental information you can read more from the source.

Energy Transfer Press Relase