This Article is Brought to you by: Allstream Energy Partners, Leaders in Digital Marketing and experts in B2AI in Oil and Gas

DALLAS–(BUSINESS WIRE)–Aug. 6, 2025– Energy Transfer LP (NYSE: ET) today announced it has reached a positive financial investment decision (FID) for the expansion of its Transwestern Pipeline to increase the supply of natural gas to markets throughout Arizona and New Mexico from Energy Transfer’s premier asset base in the prolific Permian Basin. Transwestern’s Desert Southwest pipeline expansion will provide reliable economic supplies of natural gas to support the long-term energy needs for utilities and energy providers in the region driven by population growth, high-tech industry demand and data center expansion.

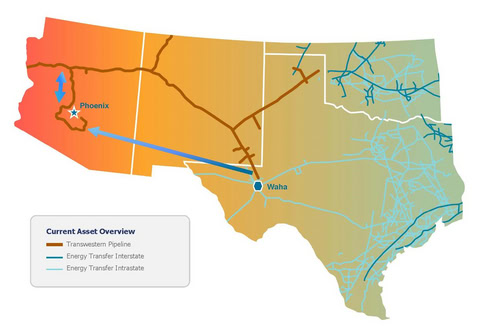

Courtesy of Energy Transfer

The Desert Southwest pipeline expansion project consists of 516 miles of 42-inch pipeline and nine compressor stations in Arizona, New Mexico and Texas. The design capacity of the pipeline is 1.5 billion cubic feet per day (Bcf/d). The strategic system expansion extends Transwestern’s natural gas pipeline network, enhancing system reliability and providing additional optionality serving rapidly growing demand in the Southwestern U.S. region. The project is expected to be in-service by the fourth quarter of 2029 and builds on Transwestern Pipeline’s long history of serving the region since it started operations in 1960.

The project is expected to cost approximately $5.3 billion including $0.6 billion of Allowance for Funds Used During Construction (AFUDC), and is supported by significant long-term commitments from investment-grade customers. Energy Transfer will launch an open season later this quarter and expects the remaining capacity to be fully subscribed upon completion of the open season. Depending on the final results of the open season, the project could be efficiently expanded to accommodate additional demand.

The project promotes American industry by prioritizing U.S. steel pipe manufacturers as well as the expectation to utilize up to 5,000 local workers and union labor construction jobs during the construction period.

Energy Transfer has assets across all major U.S. supply basins and operates an extensive natural gas pipeline network that connects to energy providers in most major markets, including nearly 200 natural gas-fired power plants nationwide. This broad supply reach and deep market access provide the partnership with unique benefits, enabling it to capitalize on opportunities to increase earnings and efficiently expand its industry-leading pipeline network.

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with approximately 140,000 miles of pipeline and associated energy infrastructure. Energy Transfer’s strategic network spans 44 states with assets in all of the major U.S. production basins. Energy Transfer is a publicly traded limited partnership with core operations that include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, natural gas liquids (“NGL”) and refined product transportation and terminalling assets; and NGL fractionation. Energy Transfer also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and approximately 21% of the outstanding common units of Sunoco LP (NYSE: SUN), and the general partner interests and approximately 38% of the outstanding common units of USA Compression Partners, LP (NYSE: USAC). For more information, visit the Energy Transfer LP website at www.energytransfer.com.

Forward Looking Statements

This news release may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results, including risks associated with growth capital projects, are discussed in the Partnership’s Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. The Partnership undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.

The information contained in this press release is available on our website at energytransfer.com.

Media Relations:

Vicki Granado

214-840-5820

Investor Relations:

Bill Baerg

Brent Ratliff

Lyndsay Hannah

214-981-0795

Source: Energy Transfer LP