This Article is brought to you by: Glex, Inc Leaders in stainless steel pipe fabrication.

- Creates a differentiated Delaware Basin produced-water system, enhancing WES’s ability to compete for new business development opportunities.

- The combined infrastructure creates a fully integrated produced-water value chain through water gathering, disposal, recycle/reuse, beneficial reuse (including desalination and mineral extraction), industrial water, and long-haul transport via the Pathfinder pipeline.

- Significantly expands WES’s New Mexico footprint unlocking new opportunities to be a “one-stop shop” for customers and to grow its natural-gas and crude-oil and NGLs gathering and processing businesses in the area.

- McNeill Ranch provides access to significant pore space and other surface use opportunities, adjacent to one of the fastest growing areas in the Permian Basin.

- Diversifies WES’s customer base through Aris’s long-term contracts, acreage dedications, and minimum-volume commitments with investment grade counterparties.

- Transaction consideration consists of a combination of equity and cash, and WES expects pro forma net leverage to remain at approximately 3.0x.

- Expected to be accretive to 2026 Free Cash Flow per unit and represents an approximate 7.5x multiple on consensus 2026 EBITDA, inclusive of estimated cost synergies.

- Targeting $40 million of estimated annualized cost synergies; further system buildout coupled with incremental natural-gas, crude-oil and NGLs, and produced-water commercial opportunities expected to deliver additional long-term synergies.

HOUSTON, Aug. 6, 2025 /PRNewswire/ — Western Midstream Partners, LP (“WES” or the “Partnership”) (NYSE: WES) and Aris Water Solutions, Inc. (“Aris”) (NYSE: ARIS) announced today that the parties have entered into a definitive agreement pursuant to which WES will acquire all of the outstanding shares of Aris in an equity-and-cash transaction valued at approximately $1.5 billion. Under the terms of the agreement, Aris shareholders will receive 0.625 common units of WES for each Aris share, with the option to elect to receive $25.00 per share in cash, subject to possible proration with a maximum total cash consideration for the transaction of $415 million. Based on WES’s closing price on August 5, 2025, and assuming maximum cash consideration, the transaction represents a premium of 10-percent to Aris’s 30-day VWAP and a premium of 23-percent to Aris’s closing price on August 5, 2025. The total enterprise value of the transaction is approximately $2.0 billion before transaction costs.

Courtesy of Aris Water

The merger agreement, which was unanimously approved by the Boards of Directors of both companies, is subject to customary closing conditions, regulatory approvals, and Aris shareholder approval, and is expected to close in the fourth quarter of 2025.

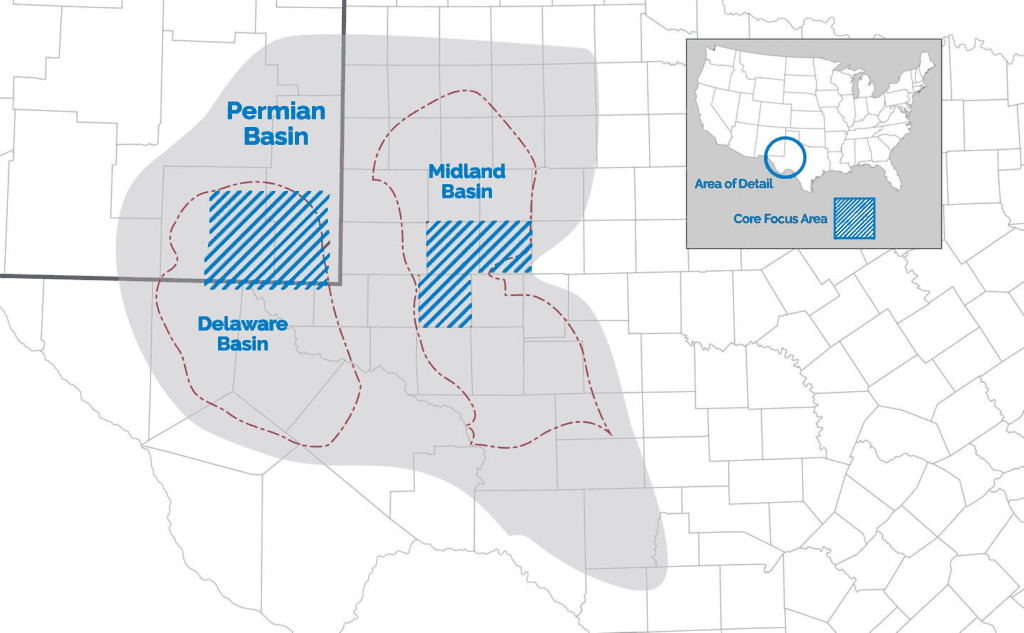

Aris’s full-cycle water infrastructure assets include approximately 790 miles of produced-water pipeline, 1,800 MBbls/d of produced-water handling capacity, 1,400 MBbls/d of water recycling capacity, and 625,000 dedicated acres from investment grade counterparties. Aris’s produced-water and water solutions volumes are supported by an average contract tenor of approximately ten and eight years, respectively. The Aris business complements WES’s existing produced-water business that includes approximately 830 miles of pipeline, total disposal capacity of 2,035 MBbls/d, and the previously announced Pathfinder pipeline project. Additionally, WES’s produced-water business is supported by long-term contracts with significant minimum-volume commitments. The integration of Aris’s assets extends WES’s existing footprint far to the north into Lea and Eddy Counties, New Mexico, providing access to incremental throughput opportunities across its natural-gas, crude-oil, and produced-water businesses. Aris’s recent purchase of the McNeill Ranch could also provide significant long-term commercial opportunities and enhanced flow assurance as the produced-water disposal needs grow in the Delaware Basin.

CEO COMMENTARY

“We are excited to announce the strategic combination with Aris, which aligns with our strategy of acquiring high-quality midstream assets that complement and expand our existing network,” commented Oscar Brown, President and Chief Executive Officer of WES.

“Aris has a strong track record of growth and operational performance in the Delaware Basin. The combination of our assets creates a leading produced-water gathering, disposal, and recycling business that can meet the flow assurance needs of customers as they execute on their decades’ worth of drilling inventory. The addition of the Aris assets better positions WES to provide enhanced flow assurance to our producing customers in West Texas while expanding WES’s commercial relationships with some of the top E&P operators in the New Mexico portion of the Delaware Basin, providing significant customer diversification and incremental opportunities for business development.”

“The McNeill Ranch, previously purchased by Aris, provides upside to our acquisition case through increased produced-water disposal capacity and other surface use opportunities. Further, Aris has valuable expertise in beneficial reuse and desalination technologies, and we are excited to be able to accelerate the research and advancement of these evolving technologies with greater access to efficient capital and economies of scale.”

“We look forward to welcoming Aris’s talented employees and dedicated investor base to our partnership. WES is proud to provide sector-leading return of capital to its unitholders through its tax-deferred distribution framework. Coupled with our long-term contract structure, investment-grade balance sheet, and with net leverage of approximately 3.0x, we offer a compelling investment opportunity to Aris shareholders and a platform to accelerate growth over the coming years,” Mr. Brown concluded.

Amanda Brock, President and CEO of Aris, commented, “Today’s transaction marks a significant milestone in Aris’s journey, and we are excited to join forces with WES. Since our founding in 2015, Aris has been dedicated to developing a sustainable produced-water infrastructure platform focused on gathering, disposal, and recycling activities for some of the largest operators in the Permian Basin. The combination of Aris and WES creates a premier midstream water-solutions provider of scale that is better positioned to deliver a variety of water services, provide critical flow assurance for natural-gas and crude-oil production activities, and generate strong returns for our shareholders through WES’s leading distribution policy and attentive focus on executing accretive growth projects. I am extremely proud of our team’s efforts and accomplishments and look forward to seeing the combined company grow.”

TERMS OF ACQUISITION

Under the terms of the merger agreement, Aris shareholders may elect to receive 0.625 WES common units, $25.00 in cash (without interest), or a combination of both, for each share of Aris common stock held, with the cash consideration being subject to proration to ensure that the total cash consideration paid by WES will not exceed $415 million of the aggregate merger consideration. In the aggregate, WES expects to issue approximately 26.6 million common units and pay approximately $415 million in cash, assuming maximum cash consideration, resulting in a total consideration mix of approximately 72-percent equity and 28-percent cash. The total transaction value is approximately $2.0 billion before transaction costs. Upon closing, and assuming maximum cash consideration, Aris shareholders are expected to own approximately 7-percent of WES’s outstanding common units. WES will leave outstanding Aris’s debt of $500 million of senior notes as of March 31, 2025. WES has entered into support agreements with Aris shareholders representing approximately 42-percent of Aris’s outstanding common stock, pursuant to which such shareholders have agreed to vote their shares of Aris common stock in favor of the transaction.

Aris is scheduled to publish its second-quarter earnings results after the market close on Monday, August 11, 2025. Given the transaction announcement, Aris will not be holding an earnings conference call for the second quarter. For additional details on WES’s acquisition of Aris, please refer to the slide presentation available under the “Events and Presentations” tab at www.westernmidstream.com.

ADVISORS

BofA Securities served as financial advisor and Vinson & Elkins LLP served as legal advisor to WES. Citi served as financial advisor and Gibson, Dunn & Crutcher LLP served as legal advisor to Aris. Houlihan Lokey served as financial advisor and Morris, Nichols, Arsht & Tunnell LLP served as legal advisor to Aris’s Audit Committee.

ABOUT ARIS WATER SOLUTIONS, INC.

Aris Water Solutions, Inc. is a leading, growth-oriented environmental infrastructure and solutions company that directly helps its customers reduce their water and carbon footprints. Aris delivers full-cycle water handling and recycling solutions that increase the sustainability of energy company operations. Its integrated pipelines and related infrastructure create long-term value by delivering high-capacity, comprehensive produced water management, recycling and supply solutions to operators in the core areas of the Permian Basin. Visit www.ariswater.com for more information.

ABOUT WESTERN MIDSTREAM

Western Midstream Partners, LP (“WES”) is a master limited partnership formed to develop, acquire, own, and operate midstream assets. With midstream assets located in Texas, New Mexico, Colorado, Utah, and Wyoming, WES is engaged in the business of gathering, compressing, treating, processing, and transporting natural gas; gathering, stabilizing, and transporting condensate, natural-gas liquids, and crude oil; and gathering and disposing of produced water for its customers. In its capacity as a natural-gas processor, WES also buys and sells residue, natural-gas liquids, and condensate on behalf of itself and its customers under certain gas processing contracts. A substantial majority of WES’s cash flows are protected from direct exposure to commodity price volatility through fee-based contracts.

For more information about WES, please visit www.westernmidstream.com.

NO OFFER OR SOLICITATION

This communication relates to a proposed business combination transaction (the “Transaction”) between Western Midstream Partners, LP (“WES”) and Aris Water Solutions, Inc. (“Aris”). This communication is for informational purposes only and does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the Transaction, WES intends to file with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form S-4, that will include a proxy statement of Aris that will also constitute a prospectus of WES. The Transaction will be submitted to Aris’s stockholders for their consideration. WES and Aris may also file other documents with the SEC regarding the Transaction. The definitive proxy statement/prospectus (if and when available) will be mailed to Aris’s shareholders. This document is not a substitute for the registration statement and proxy statement/prospectus that will be filed with the SEC or any other documents that WES or Aris may file with the SEC or send to security holders of WES or Aris in connection with the Transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF WES AND ARIS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS.

Investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (when available) and all other documents filed or that will be filed with the SEC by WES or Aris through the website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by WES will be made available free of charge on WES’s website at investors.westernmidstream.com, or by directing a request to Investor Relations, Western Midstream Partners, LP, 9950 Woodloch Forest Drive, Suite 2800, The Woodlands, TX 77380, Tel. No. (832) 636-1009. Copies of documents filed with the SEC by Aris will be made available free of charge on Aris’s website at ir.ariswater.com or by directing a request to Investor Relations, Aris Water Solutions, Inc., 9651 Katy Freeway, Suite 400, Houston, TX 77024, Tel. No. (832) 304-7003.

PARTICIPANTS IN THE SOLICITATION

WES, its general partner and its general partner’s director and officers and Aris and its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the Transaction.

Information regarding directors and executive officers of WES’s general partner, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth (i) in WES’s Annual Report on Form 10-K for the year ended December 31, 2024, including under Part III, Item 10. Directors, Executive Officers, and Corporate Governance, Part III, Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters and Part III, Item 13. Certain Relationships and Related Transactions, and Director Independence, which was filed with the SEC on February 26, 2025 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0001423902/000142390225000033/wes-20241231.htm and (ii) to the extent holdings of WES’s securities by the directors or executive officers of its general partner have changed since the amounts set forth in WES’s Annual Report on Form 10-K for the year ended December 31, 2024, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at https://www.sec.gov/cgi-bin/own-disp?action=getissuer&CIK=0001423902.

Information regarding Aris’s executive officers and directors, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth (i) in Aris’s definitive proxy statement for its 2025 Annual Meeting of Stockholders, including under the headings “Proposal One — Election of Directors,” “Executive Officers,” “Executive Compensation,” “Certain Relationships and Related Party Transactions,” and “Beneficial Ownership of Securities,” which was filed with the SEC on April 9, 2025 and is available at https://www.sec.gov/Archives/edgar/data/1865187/000119312525076892/d881669ddef14a.htm, and Aris’s Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 27, 2025 and is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0001865187/000155837025001818/aris-20241231x10k.htm and (ii) to the extent holdings of Aris’s securities by its directors or executive officers have changed since the amounts set forth in Aris’s definitive proxy statement for its 2025 Annual Meeting of Stockholders, such changes have been or will be reflected on Initial Statement of Beneficial Ownership of Securities on Form 3, Statement of Changes in Beneficial Ownership on Form 4, or Annual Statement of Changes in Beneficial Ownership on Form 5 filed with the SEC, which are available at https://www.sec.gov/cgi-bin/own-disp?action=getissuer&CIK=0001865187.

Investors may obtain additional information regarding the direct and indirect interests of those persons and other persons who may be deemed participants in the Transaction by reading the proxy statement/prospectus regarding the Transaction and other materials filed with the SEC regarding the Transaction when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from WES or Aris as described above.

FORWARD-LOOKING STATEMENTS AND CAUTIONARY STATEMENTS

The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that WES or Aris expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “may,” “should,” “foresee,” “plan,” “will,” “guidance,” “outlook,” “goal,” “future,” “assume,” “forecast,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the Transaction, the parties’ ability to complete the Transaction and expected timing of completion, descriptions of the combined company and its operations, integration and transition plans, synergies, opportunities and anticipated future performance. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction that could reduce anticipated benefits or cause the parties to abandon the Transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the possibility that stockholders of Aris may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions under the merger agreement in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the Transaction, the risk that any announcements relating to the Transaction could have adverse effects on the market price of WES’s common units or Aris’s Class A common stock, the risk that the Transaction and its announcement could have an adverse effect on the ability of WES and Aris to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk the pending Transaction could distract management of both entities and they will incur substantial costs, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or it may take longer than expected to achieve those synergies and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond WES’s or Aris’s control, including those detailed in WES’s most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on its website at investors.westernmidstream.com and on the SEC’s website at http://www.sec.gov, and those detailed in Aris’s most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on Aris’s website at ir.ariswater.com and on the SEC’s website at http://www.sec.gov. All forward-looking statements are based on assumptions that WES or Aris believe to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and WES and Aris undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

WESTERN MIDSTREAM CONTACTS

Daniel Jenkins

Director, Investor Relations

Investors@westernmidstream.com

866-512-3523

Rhianna Disch

Manager, Investor Relations

Investors@westernmidstream.com

866-512-3523

SOURCE Western Midstream Partners, LP